Texas title loan financing offers quick cash using a vehicle's title as collateral, but it carries high interest rates and risks, especially for those with low credit scores. To avoid debt cycles, Texans should budget repayment into their finances, seek non-profit assistance, and maintain financial stability to overcome the challenges of these short-term loans.

In the competitive landscape of Texas title loan financing, understanding the intricate mechanisms, potential credit impact, and recovery strategies is paramount. This article delves into the intricacies of Texas title loan financing, exploring its unique features and how they can affect borrowers’ credit scores. We discuss the risks, consequences, and most importantly, provide valuable recovery tips to help Texans navigate this alternative financing option responsibly.

- Understanding Texas Title Loan Financing Mechanisms

- The Credit Impact: Risks and Consequences

- Recovery Strategies for Title Loan Borrowers in Texas

Understanding Texas Title Loan Financing Mechanisms

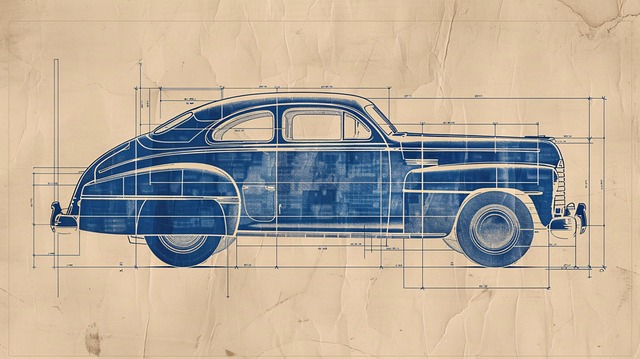

Texas title loan financing operates on a unique model where individuals can access quick funds by using their vehicle’s title as collateral. This alternative financing option is particularly popular in Texas, catering to those in need of immediate financial support. The process involves a lender assessing the value of the borrower’s vehicle and offering a loan amount based on that appraisal. Once approved, borrowers receive cash, providing relief during financial emergencies.

The key aspect of these loans lies in their structure: secure and short-term. Lenders retain the rights to repossess the collateral (the vehicle) if the borrower defaults on payments, which typically include regular interest charges. Understanding interest rates is crucial; they can vary widely among lenders, impacting the overall cost of the loan. For instance, San Antonio loans might offer competitive rates, allowing borrowers to manage their repayments effectively and potentially extend their loan terms if needed, ensuring better financial flexibility.

The Credit Impact: Risks and Consequences

Texas title loan financing can have significant credit impacts, especially when not managed responsibly. These loans, which are secured by your vehicle’s title, come with high-interest rates and short repayment periods, making them a risky financial option. Borrowers often find themselves in a cycle of debt, struggling to repay the principal along with substantial interest charges. This can lead to default, resulting in repossession of the vehicle, causing severe financial strain on the borrower.

Additionally, the process of obtaining a Texas title loan often involves stringent requirements and aggressive lending practices. Lenders may charge hidden fees, offer unclear terms, and pressure borrowers into taking out larger loans than they can afford. This is particularly concerning for individuals with already low credit scores or limited financial stability. Moreover, failure to repay can negatively affect your credit report, further hindering future borrowing opportunities, including more traditional loan options like Dallas title loans that require direct deposit. Keeping your vehicle during the loan period is a crucial aspect of these deals, but it doesn’t mitigate the potential long-term consequences if repayment becomes unmanageable.

Recovery Strategies for Title Loan Borrowers in Texas

For Texas residents facing financial strain, a Texas title loan financing option can serve as a temporary financial solution. However, it’s crucial to have a recovery plan in place to avoid falling into a cycle of debt. One key strategy is creating a budget that accounts for loan repayments while allocating funds for essential expenses and savings. This ensures borrowers stay on top of their obligations and work towards financial stability.

Seeking financial assistance from non-profit organizations or community resources can also be beneficial. These groups often offer counseling, budgeting workshops, and emergency funding opportunities to help individuals regain control of their finances. By combining these strategies, Texas title loan borrowers can navigate the repayment process more effectively and ultimately move towards a brighter financial future.

Texas title loan financing, while offering quick access to cash, comes with significant risks. The credit impact can be severe, affecting borrowers’ financial stability and future prospects. However, there are recovery strategies available for those in Texas who have taken out such loans. By understanding the mechanisms, recognizing potential consequences, and exploring rehabilitation options, borrowers can work towards a more secure financial future.