Texas title loan financing offers a swift cash solution for borrowers with a clear vehicle title, bypassing traditional credit checks. The process starts online, followed by same-day funding based on vehicle equity. Borrowers have rights and responsibilities, including clear term disclosure and the right to conduct a vehicle inspection. Flexible payment options are available, and adhering to responsibilities protects both parties. Proactive vigilance is crucial when securing Texas title loan financing; compare lenders, read loan documents thoroughly, and understand your rights to ensure fairness and peace of mind.

In the competitive financial landscape of Texas, understanding your rights and responsibilities is crucial when considering a title loan. This comprehensive guide aims to demystify Texas title loan financing, providing an in-depth overview for borrowers. We explore your legal rights and obligations, ensuring you’re protected against predatory practices. Learn how to navigate the process intelligently, making informed decisions while leveraging your rights in this dynamic market. Key focus: Texas title loan financing made transparent.

- Understanding Texas Title Loan Financing: A Comprehensive Overview

- Your Legal Rights and Responsibilities When Taking Out a Title Loan in Texas

- Navigating the Process: How to Ensure Fair Practices and Protect Yourself Legally

Understanding Texas Title Loan Financing: A Comprehensive Overview

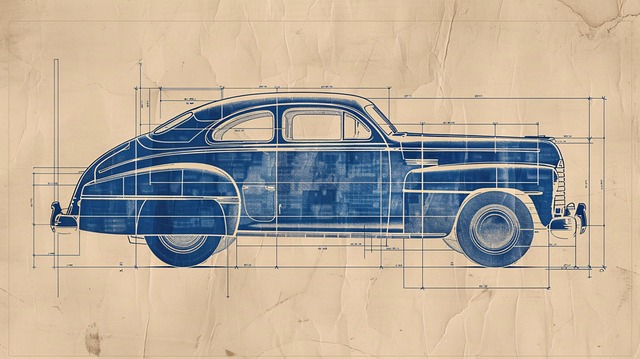

Texas title loan financing offers a unique approach to accessing quick cash, secured by the title of your vehicle. This type of loan is designed for borrowers who need immediate financial assistance and have a clear car title in their name. Unlike traditional loans, the focus here is on the value of your vehicle rather than your credit score. This makes it an attractive option for those with limited credit history or poor credit ratings.

The process begins with an online application where you provide details about your vehicle, including its make, model, year, and mileage. After submission, a lender will evaluate your application and, if approved, you could receive same-day funding. Loan approval is determined by the equity in your vehicle, ensuring that even with less-than-perfect credit, there’s still a chance to gain access to funds quickly.

Your Legal Rights and Responsibilities When Taking Out a Title Loan in Texas

When you secure a Texas title loan financing, it’s crucial to understand your rights and responsibilities. First and foremost, as a borrower, you have the right to know the terms and conditions of the loan clearly. This includes understanding the interest rates, fees, and the overall cost of borrowing. Lenders in Texas are required to provide you with a comprehensive disclosure statement outlining these details, ensuring transparency throughout the process.

Moreover, you have the legal right to request and conduct a vehicle inspection before finalizing the loan. This step is essential as it allows you to verify the condition of your collateral, ensuring it aligns with the lender’s assessment. Additionally, Texas title loans often offer flexible payment options, enabling borrowers to tailor their repayments according to their financial capabilities. Remember, while these loans can provide quick approval, adhering to your responsibilities will protect both you and the lender from potential disputes.

Navigating the Process: How to Ensure Fair Practices and Protect Yourself Legally

Navigating the process of securing a Texas title loan financing involves understanding your rights and protecting yourself from unfair practices. It’s crucial to approach this alternative financing option with caution, as these loans are secured against your vehicle’s title. Begin by comparing lenders; reputable companies will offer transparent terms and rates, including clear details on interest calculations and repayment schedules. This is especially important when considering options like boat title loans, which can vary widely in terms of cost.

Before signing any documents, read every clause carefully. Ensure there are no hidden fees or penalties. As with any loan, a thorough credit check is typically involved, but you have the right to know how your information will be used and protected. Understanding these practices and your legal standing can help ensure a fair transaction, providing peace of mind during what can often be a stressful financial situation.

When considering a Texas title loan financing, understanding your legal rights is paramount. By familiarizing yourself with the process, your responsibilities, and fair practice guidelines, you can navigate this type of lending confidently and protect yourself from potential pitfalls. Remember, knowledge is power when it comes to managing your financial future.